5 Simple Techniques For Bank Certificate

Wiki Article

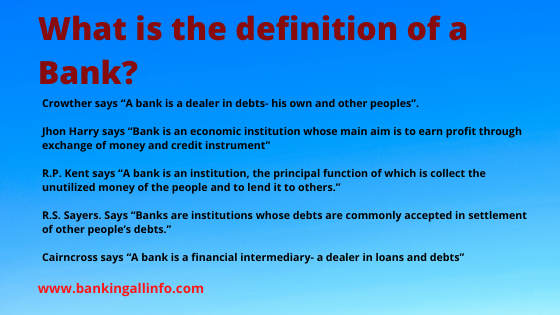

The Main Principles Of Bank Definition

Table of ContentsThe 8-Minute Rule for Bank DefinitionUnknown Facts About Bank Draft MeaningThe smart Trick of Bank Statement That Nobody is Talking AboutThe 2-Minute Rule for Bank Account NumberThe Ultimate Guide To Bank Draft MeaningThe 10-Second Trick For Bank Account Number5 Simple Techniques For Bank

This aids you get the points you require and it likewise assists the economic situation grow, potentially hiking inflation. Reduced rates of interest on business loans imply that firms can obtain cash more cheaply as well as hence have accessibility to more money, making them likely to invest even more money to work with workers, claim, or increase wages.People as well as businesses commonly spend less and also conserve more when rate of interest are high, which assists to slow down the economy and also often brings about depreciation. Depreciation can make borrowing much more pricey and the task market extra competitive, yet it provides your dollars more purchasing power. Keeping the economy from not getting too hot and too cold sounds deceptively simple.

The offers for monetary products you see on our system originated from business who pay us. The cash we make assists us provide you access to totally free credit history as well as reports as well as helps us produce our various other excellent tools and educational products. Payment might factor right into just how as well as where products appear on our system (and also in what order).

Indicators on Bank Reconciliation You Need To Know

That's why we give functions like your Authorization Probabilities as well as financial savings estimates. Certainly, the deals on our platform don't stand for all economic products around, however our goal is to reveal you as many great options as we can. Even a single sort of financial institution could offer different types of savings account, including checking, financial savings and money market accounts.However they usually companion with a traditional financial institution that holds customers' down payments and manages the behind-the-scenes financial resources. There are a couple of exemptions, though online banks are starting to get approved for national charters or acquiring tiny banks that currently have a nationwide charter. banking. And typical brick-and-mortar financial institutions can use online-only checking account or produce online-only bank brand names.

Unlike financial institutions, which are exclusively had by shareholders, customers and also investors can mutually possess a thrift. Historically, there were limitations on the kinds of products a thrift might bank etf use. Today, you may discover that second hands and financial institutions offer comparable sorts of consumer accounts. Yet federal regulations have typically restricted the types of industrial accounts and also company car loans they might participate in.

The Of Bank Reconciliation

There are some monetary organizations that supply fundings but don't accept down payments and aren't banks.In basic, you'll want to make certain your account is guaranteed by either the FDIC (for financial institutions) or NCUA (for credit rating unions). The insurance hides to $250,000 in down payments, which stands as a federal assurance that you'll get your cash if the bank or credit report union goes under.

Louis De, Nicola is a personal money writer and also has composed for American Express, Discover as well as Nova Credit Rating. In addition to being an adding writer at Credit report Karma, you can locate his work with Business Expert, Cheapi Find out more..

Indicators on Bank Definition You Should Know

If you're registered in this safety function, we sent an alert to your registered tool. Verify your identity in the app now to Log In to Online Financial. We can not determine you at this time. Please use your User ID/Password to Visit.

In terms of financial institutions, the reserve bank is the boss. Reserve banks handle the money supply in a single nation or a collection of nations. They supervise industrial banks, set passion prices and manage the flow of money. Reserve banks additionally apply a federal government's financial policy goals, whether that involves combating depreciation or keeping rates from changing.

Indicators on Banking You Should Know

Much like the common controlled banks, darkness banks deal with credit history and various kinds of possessions. They get their financing by obtaining it, connecting with financiers or making their own funds rather of using cash provided by the main bank.

Cooperatives can be either retail banks or industrial banks. What identifies them from various other entities in the financial system is the fact that they're usually regional or community-based associations whose members aid establish how the service is operated. They're run democratically and they offer lendings and also banks accounts, to name a few points.

Some Ideas on Bank Definition You Need To Know

Like financial institutions, credit unions provide lendings, offer financial savings and examining accounts and satisfy various other economic demands for customers and also services. The distinction is that financial institutions are for-profit companies while credit Get the facts scores unions are not.Participants profited from the S&L's services as well as made even more rate of interest from their financial savings than they could at commercial banks. Not all banks serve the very same purpose.

Banking for Beginners

It doesn't occur with one purchase, in eventually on duty, or in one quarter. It's earned partnership by connection.Report this wiki page